Overview:

In a special called meeting on Monday, Atlanta Public Schools voted to maintain the current millage rate of 20.500, with a vote of 5-0 with four board members not in attendance.

In a special called meeting on Monday, Atlanta Public Schools voted to maintain the current millage rate of 20.500, with a vote of 5-0 with four board members not in attendance.

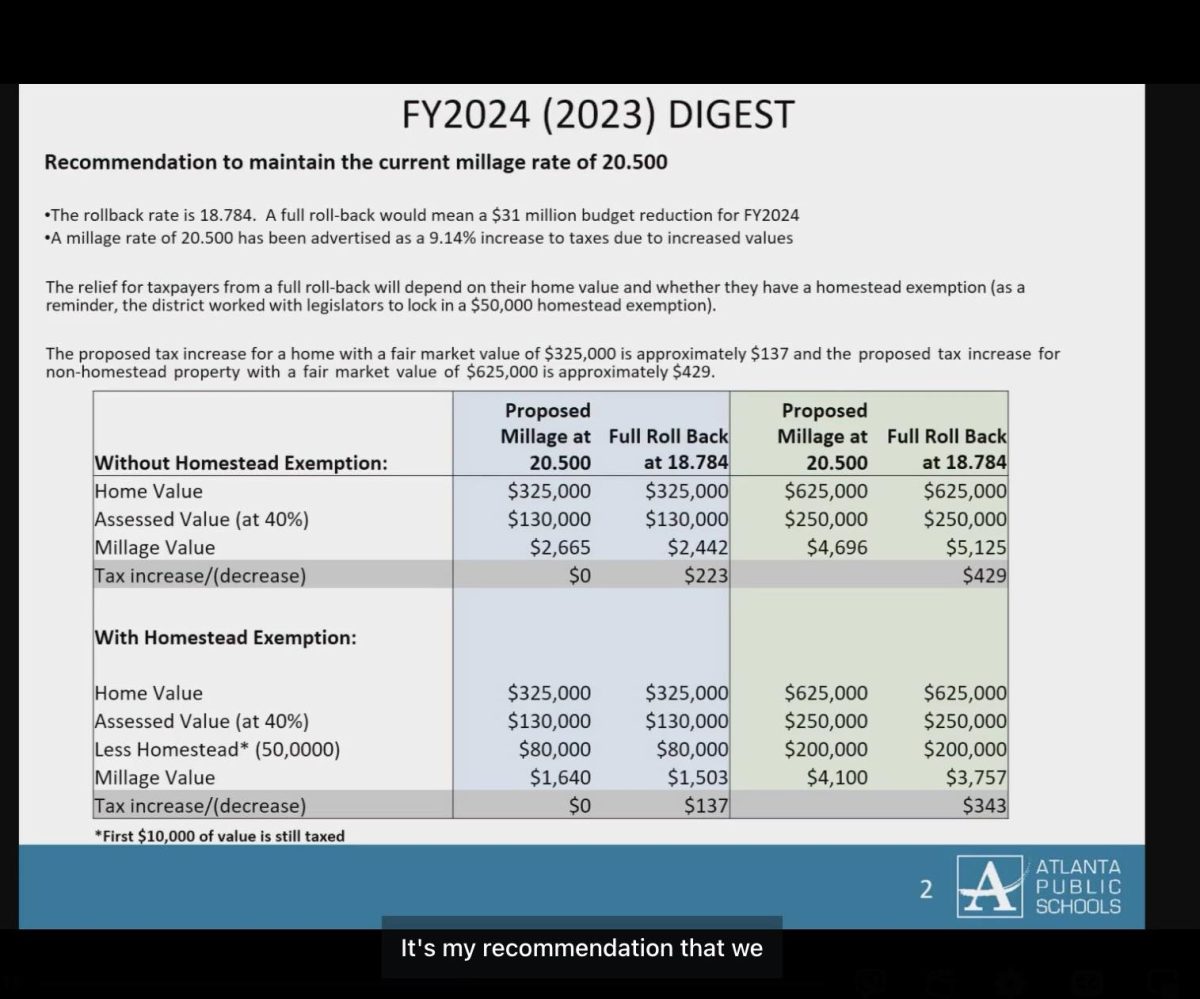

Chief Financial Officer Lisa Bracken’s overview of the 2024 tax digest stressed that despite keeping the millage rate the same, due to increased property values, there would be a 9.14% increase in taxes.

With an operating budget of over $1.6 billion for the 2023-2024 school year, many board members expressed concerns about the rising property values and its impact on many legacy families where grandparents may raise their grandchildren.

“A lot of people are feeling the pinch with the new evaluations and I’m really appreciative of the district working with the legislature for the $50,000 homestead exemptions.” Said Tamara Jones, At-Large Seat 7 Representative. “What are the possibilities for us to start to explore that in a different way going forward? I know a lot of our legacy residents are being pushed out.”

One speaker came to speak about the difference in taxes from Cobb County to the City of Atlanta and why residents in Cobb County pay less in taxes than those with similar home values.

=

Thank you for this detailed overview of the Atlanta Public Schools’ decision to maintain the millage rate at 20.5, resulting in a 9.14% tax increase due to rising property values. The article effectively highlights the challenges faced by legacy residents amid these changes.

I have a couple of questions:

Support for Vulnerable Populations: Given the concerns about the impact on elderly homeowners and legacy residents, are there any specific programs or exemptions being considered to alleviate their tax burden?

Budget Allocation Transparency: With the increased revenue from property taxes, how does the district plan to allocate these funds to ensure they directly benefit students and address educational disparities?

Understanding these aspects would provide valuable insights into how the district balances fiscal responsibilities with community support.

Looking forward to your insights on these matters.